This is Part 2 of our Tax Time Series.

Tax time is around the corner. If you are anything like us, you might have already earmarked the refund money for several things. Roughly 84% of Australian taxpayers can anticipate a refund of $3000 this year. If you dread this time of the year, this might just be the thing to perk you up.

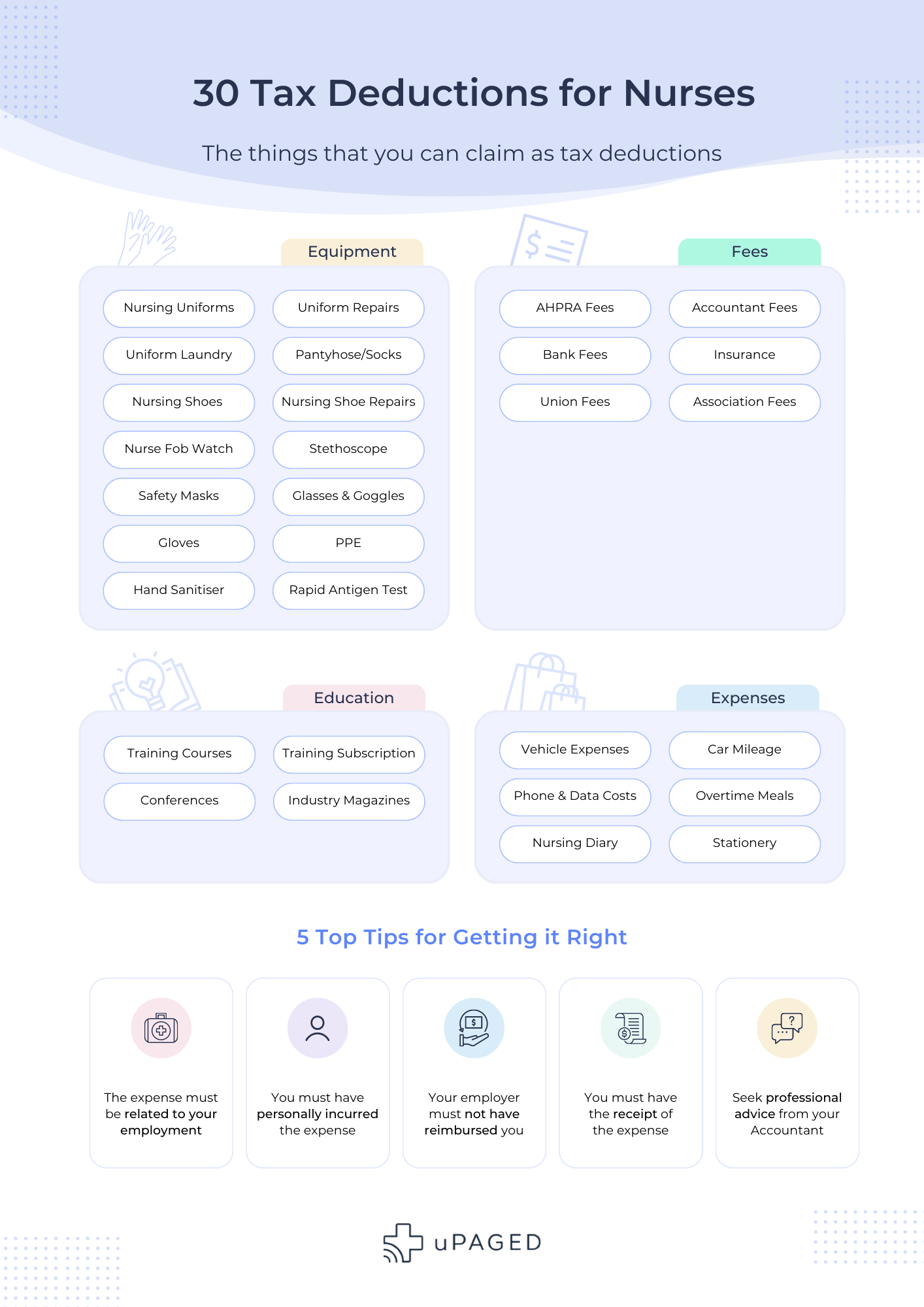

We have created this handy infographic with a complete list of things nurses can claim as tax deductions. Save it, share it and store it for later… we bet it is going to make crunching those numbers easy peasy.

30 Things* You Can Claim As Tax Deductions

Get the full story on what you can and can’t claim in part 1 of this series – What can Nurses Claim on Taxes?

*Always check with your accountant who will assess your individual circumstances as to what you can and cannot claim. This is not financial, tax, or accounting advice. We are not accountants, so make sure you check with yours regarding what and how much you may be able to claim.

**While it is tempting to claim as much as possible, make sure your claims are legit.

Note – The ATO can fine you for false claims. Even if you use pre-filled information, verify the following data before signing off on your tax:

- Bank details – double-check your BSB and bank account number

- ATO info – have you moved to a new house or changed your name? Ensure your name and address are correct so ATO can match your information with your TFN.

- Claim ALL your income, including the casual shifts you did from uPaged or any gains from cryptocurrency, in addition to your full-time job. ATO is cracking down on the gig economy and cryptocurrency. So if you have received any $$$ from doing Uber, Airtasker, Airbnb or selling Dogecoin, ensure you add all your income.

Do you think your overtime shifts put you in the higher tax bracket?

Afraid to take up shifts to pay less tax?

We answer these questions in our next post. Don’t go anywhere just yet – read the third and final part in this series – The Myth of the Higher Tax Bracket.