Are You Declining Extra Shifts and Overtime Work because of Higher Taxes?

Is overtime taxed more? Should you decline overtime or extra nursing shifts to save money? Find out all about this in our Tax Time Series last and final part.

Does working overtime mean more tax for me?

You might wonder whether working overtime or accepting night shifts will push you into the next tax bracket, leading to higher taxes and lower earnings. However, this is just not true! This assumption could lead you to decline extra shifts and overtime work. We explain the tax process through an example that will make it clear. Keep reading to find out more.

The Benefits of Progressive Tax Rate

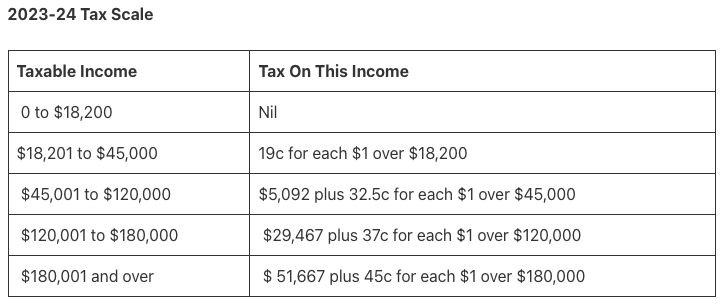

The progressive tax rate in Australia ensures that your average tax rate remains much lower than the marginal rate. In this system, your average tax rate is calculated by dividing the amount of tax you pay by your income. On the other hand, the marginal tax rate represents the tax paid for every additional dollar earned as income. Therefore, if another source of income pushes you into the next tax bracket, it doesn’t imply that all your income is now taxed at the higher rate.

So what does that mean? Only a part of your income will be taxed at a higher rate if you earn an additional $10,000 in overtime or extra shifts and move to the next tax bracket.

For example, Grace is a Level 4 Registered Nurse in the ACT. She is single and has no dependents. She works full-time in a mid-sized private hospital. Her salary is $80,000 per annum, excluding 10% super.

At the end of the year, when calculating her taxes, the ATO will split her salary as follows: $18,200 taxed at 0%; $26,800 ($45,000-$18,200) taxed at 19%; and $35,000 ($80,000-$45,000) taxed at 32.5%.

See the new 2023-2024 marginal tax rate table below:

Source from ATO Tax Rate 2023-2024

Grace loves traveling and wants to save some extra money for her trip. London and Thailand have been on her wishlist for years. To achieve that goal, she picks up an extra 12-hour shift every week through uPaged. She earns an additional $40,100 through this work. This additional amount brings her total assessable income to $120,100. This income pushes her up to the next marginal tax rate bracket, $120,001 – $180,000 (see table above). This doesn’t mean the entire salary will be taxed at 37%.

In fact, only the additional $100 will be taxed at 37%. You can calculate your income after tax with ATO Tax Calculator

Australia’s progressive tax rate and the extra work made available through uPaged means that Grace actually gains $27,063 after tax. That’s a lot of lettuce (or $10 punnets of strawberries, or a massive wodge off your mortgage, or whatever is pushing your cost of living expenses through the roof ATM!)

This year, Grace is using that money to pay for a 4-week trip to London and will be enjoying a 5-day stay at a glitzy spa hotel on Koh Samui in Thailand on her way home 🏖

The main thing to note is that you still get more money in hand. Better still, you would also likely get a tax refund at the end of the year. And it’s always great to get a refund at the end of the year, right? Remember, every dollar counts!

(Oh, and here’s our disclaimer–we’re not accountants—so you really need to check with yours to find out exactly what, and how much, you can claim). Need an accountant who specialises in tax for Nurses? Email us at hello@uPaged.com and we’ll connect you with our favourites.

Reference

The Australian Taxation Office